This month, we are talking about a finance option that has gained popularity in recent years; that is the Limited Recourse Borrowing Arrangement (LRBA) for Self Managed Superannuation Funds (SMSFs). If you’re considering your retirement savings, or perhaps exploring new investment avenues, this article is for you. We’ll look at the benefits, risks, and the process of borrowing money for your SMSF through an LRBA.

Benefits of Using an LRBA for Your SMSF:

Leveraging Your Investment: With an LRBA, you can leverage your SMSF’s capital by borrowing to purchase assets. Borrowing can potentially boost your returns if the investments perform well. Borrowing can also magnify your risks, please refer to the next section.

Diversification of Investments: A key advantage of using an LRBA is the ability to diversify your investment portfolio. Instead of relying on traditional assets like managed funds and shares, you can invest in assets such as residential and commercial properties.

Tax Benefits: SMSFs are known for their favourable tax treatment, and LRBAs can enhance these benefits. Income generated from investments held within the SMSF is typically taxed at a concessional rate, potentially reducing your tax liability.

Control and Flexibility: An SMSF with an LRBA gives you greater control over your investments and the flexibility to tailor your portfolio to your financial goals. You can choose the assets that align with your risk and investment strategy, as opposed to to relying on a fund manager who you have never met.

Risks to Consider:

Interest Rate Fluctuations: Borrowing via an LRBA exposes your SMSF to interest rate risk. At the time of writing this, we’ve seen the most dramatic increase in rates for a long time. If/ when interest rates rise, your loan repayments may increase, impacting your fund’s cash flow.

Property Market Volatility: If your SMSF invests in property, it’s crucial to be aware of the property market’s ups and downs. Property values can fluctuate, affecting the overall performance of your SMSF. As with any investment strategy, it’s important to consider the diversity of your portfolio.

Loan Repayment Obligations: SMSFs with LRBAs must meet loan repayment obligations, which can be a significant commitment. Failing to make repayments on time could lead to penalties and a potential loan default and potentially a forced sale of the asset.

Complexity and Costs: Setting up and managing an LRBA can be complex and may involve additional costs, such as legal and administrative fees. It’s important to carefully consider whether the potential benefits outweigh these costs.

The Process of Borrowing Money via an LRBA for Your SMSF

Seek Professional Advice: Before considering an LRBA, consult with financial advisors, accountants, and legal experts who specialise in SMSFs. They can help you assess whether an LRBA is suitable for your financial goals.

Create or Update Your SMSF Trust Deed: Ensure that your SMSF’s trust deed allows for LRBAs. If it doesn’t, you may need to update it.

Select the Asset: Choose the investment asset you wish to purchase with the borrowed funds. It could be property, shares, or another asset that complies with SMSF regulations.

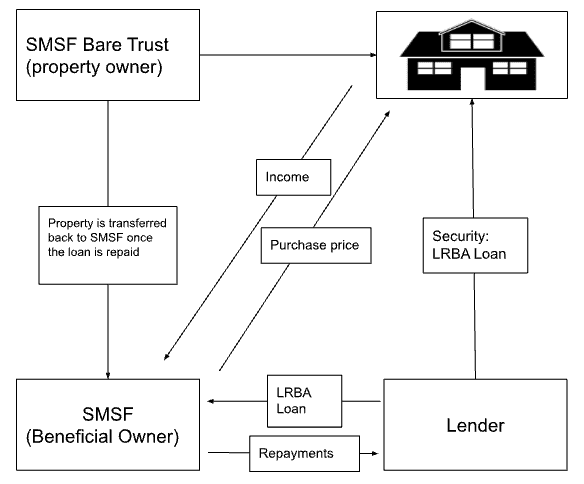

Secure Financing: Apply for a loan through your SMSF. Keep in mind that the loan must be a limited recourse loan, meaning the lender’s recourse is limited to the asset purchased with the borrowed funds.

Ensure Compliance: Your SMSF must adhere to strict compliance regulations, including annual audits, reporting, and repayment of the loan from SMSF assets.

Monitor and Manage: Continuously monitor your investment and loan performance. Adjust your strategy as needed to ensure your SMSF remains on track to meet its financial goals.

Conclusion:

Borrowing money for your SMSF through an LRBA can be a powerful tool for building wealth. However, it comes with risks and complexities that require careful consideration and expert guidance. By understanding the benefits, risks, and the process involved, you can make informed decisions to maximise the potential of your Self Managed Superannuation Fund. Remember, the key to success is a well-thought-out strategy and ongoing diligence in managing your investments.

Please note that all of the above is general advice. We can provide you with Credit Guidance on the LRBA loan however, we are not qualified to give investment or tax advice. When we write an SMSF loan, we will work closely with your financial partners, including your accountant, financial planner and lawyer. If you do not have any of these contacts, we can introduce you to someone in our circle of trusted advisers.